Will a divided Washington make a deal to provide further aid to Ukraine?

The market views that as likely, at least if you go by the advance made by the SPDR S&P Aerospace & Defense ETF

XAR.

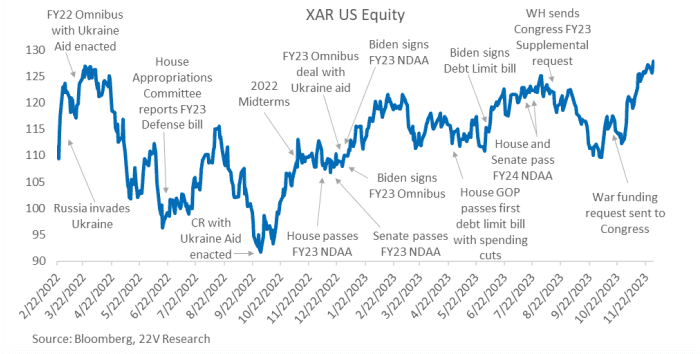

That’s according to 22V Research analysts Kim Wallace and Sandra Namoos, who said in a note Friday that the exchange-traded fund is a “reliable sentiment indicator of war funding, NDAA, and routine FY24 defense appropriations.” NDAA refers to the National Defense Authorization Act, an annual Pentagon funding package.

“XAR is up 0.5% this week through Thursday’s close with momentum strongest yesterday as final action for the package of national security legislation gained certainty,” the analysts wrote, as they shared the chart below.

22V Research

“Risks seem tied more to timing than results, meaning war funding could slip into January but the notion of no funding or delayed money to Ukraine has fallen by the wayside.”

The ETF — which tracks stocks such as Spirit AeroSystems

SPR,

General Dynamics

GD,

Northrop Grumman

NOC,

and Boeing

BA,

— was gaining more ground on Friday, as the broad market

SPX

also moved higher. That’s putting the ETF on pace for a weekly climb of about 2%.

“U.S. southern border security agreements likely will facilitate money for Kyiv, and explicit expectations for the protection of war-zone civilians will do the same for passage of Israel funds,” 22V’s team also said. “Whether the House of Representatives require those bills split or can vote on a combined package remains uncertain but is no longer a stumbling block.”

And see: Israel–Hamas war boosts U.S. defense ETFs, but here’s why it may not help for long

Ukrainian President Volodymyr Zelensky on Thursday said his nation’s war with Russia is in a new stage, with winter expected to complicate fighting after a summer counteroffensive that failed to produce desired results. He also said he fears the Israel-Hamas war threatens to overshadow the conflict in Ukraine.

Source link