A popular pandemic spot for banks, money-market funds and financial institutions to park cash overnight with the Federal Reserve could provide a boost to Treasury market liquidity.

A year ago, use of the Fed’s popular overnight reverse repo facility swelled to a peak of almost $2.6 trillion, but it since has dwindled to about $834 billion as of Tuesday, marking roughly the lowest daily demand in more than two years.

Diminished use of the facility appears to reflect increased confidence about the Fed wrapping up its most aggressive cycle of rate hikes in decades, with the central bank next week expected to hold its policy rate steady at a 22-year high, and to begin cutting rates sometime in the year ahead.

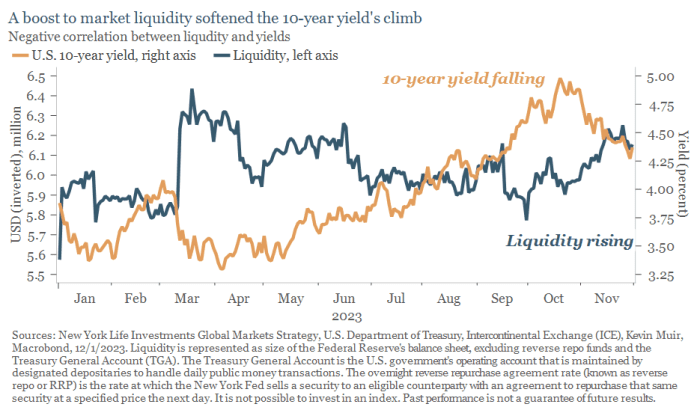

Lauren Goodwin, economist and portfolio strategist at New York Life Investments, said she thinks falling demand for the facility also may reflect rising market liquidity. Her team found that a liquidity boost this fall helped ease the 10-year Treasury yield

BX:TMUBMUSD10Y

back from a peak of 5% in October.

Banks, money-market funds and other financial institutions can boost liquidity in the $26 trillion Treasury market by moving cash out of the Fed’s reverse repo facility.

The sharp rise in the benchmark 10-year Treasury yield in October sparked a correction in the S&P 500 index

SPX

and the Nasdaq Composite Index,

COMP

which was quickly exited as yields retreated and both equity gauges rose at least 10% from their recent lows.

Goodwin argued in a Tuesday client note that rising interest rates also can prompt financial institutions to shift funds from the Fed’s reverse repo facility to the $26 trillion Treasury market, “effectively pumping liquidity into the economy.”

“This increase in liquidity facilitates a redistribution of risk and in this cycle, we’ve observed a pattern where greater liquidity correlates with lower yields and vice versa.”

Related: As T-bill yields climb, Fed’s reverse repo facility shrinks to lowest level in 1½ years

High demand for the Fed facility has been viewed as an aftershock of pandemic-era liquidity sloshing through financial markets. A worry has been that the process of draining liquidity from markets could produce ugly shocks, including in stocks, bonds and other financial assets that may threaten financial stability — which could then prompt more monetary easing from the Fed.

There have been jitters about potential ripple effects in markets when the balance held in the Fed’s reverse repo facility nears zero.

Still, Goodwin said she sees a floor on the benchmark 10-year Treasury yield of 3.5% to 3.75%, even in a recession scenario.

“A drawdown in Treasury market liquidity related to banks’ financial plumbing, as well as the supply and demand issues working out in the long end of the curve, put some upward pressure on yields in our views,” she said.

Instead, she said she thinks it would likely take a “serious” slowdown in economic growth “beyond the mild recession we expect,” to push the 10-year Treasury yield down closer to 3.0%.

Related: Bond market signals a swift U.S. economic slowdown isn’t off the table

Source link