“Does the GRANOLAS’ impressive trailing performance mean the group is a good bet going forward? ”

Wall Street loves a good story, as evidenced by the recent focus on a group of stocks called the “GRANOLAS.” These are a group of 11 European stocks that have led Europe’s stock markets higher. They are: GSK

GSK,

Roche Holding

RHHBY,

ASML Holding

ASML,

Nestle

NSRGY,

Novartis

NVS,

Novo Nordisk

NVO,

L’Oreal

LRLCY,

LVMH Moët Hennessy Louis Vuitton

LVMUY,

AstraZeneca

AZN,

SAP

SAP

and Sanofi

SNY.

(Stock tickers listed are for U.S.-listed American Depositary Receipts.)

In mid-February, Goldman Sachs (the firm that created the grouping and the acronym in 2020) calculated that 60% of the European stock market’s gains over the past two years were produced by the GRANOLAS. Over that period the European group even outperformed the so-called Magnificent Seven stocks in the U.S. — Alphabet

GOOG

GOOGL,

Amazon.com

AMZN,

Apple

AAPL,

Meta Platforms

META,

Microsoft

MSFT,

Nvidia

NVDA

and Tesla

TSLA.

Does the GRANOLAS’ impressive trailing performance mean the group is a good bet going forward? History does not provide much encouragement.

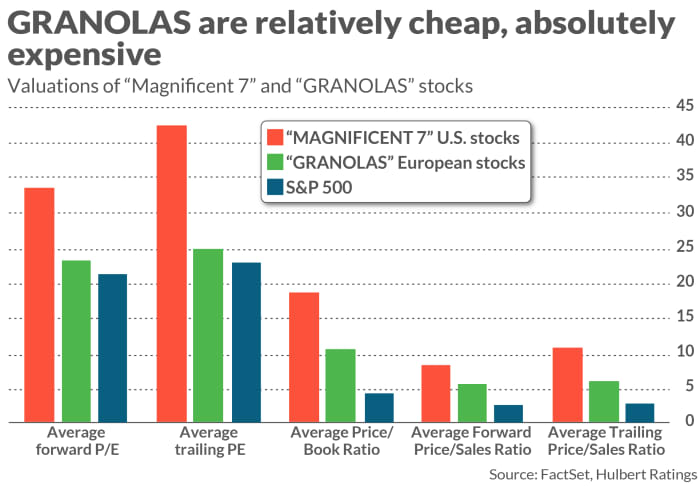

That is not surprising, since when they are created the only thing the stocks within a particular group have in common is that they have produced spectacular trailing returns. That invariably means that the stocks are richly valued, if not outright overvalued. This very much is the case with both the GRANOLAS and the Magnificent Seven, as you can see from the accompanying chart.

Though overvalued stocks can become even more overvalued over the shorter term, it’s nearly certain that on average over the longer term they will underperform the market. The law of gravity eventually wins out, and when that happens you can bet that Wall Street will simply create a new group of top performers and give them a catchy title.

We’ve seen this script play out over the last decade, as poor-performing stocks are removed from one focus group and a new group is created with a separate group of stellar performers. Remember FANG? The group was all the rage for several years and then fell out of favor. It then morphed into FAANG, then FAAMG, and now MAMAA — or the Magnificent Seven, depending on which family tree you pay attention to.

Creative destruction

This continual process of companies dropping out of the stock-market winners category and being replaced by new winners is inherent to the financial markets. Joseph Schumpeter, the late Austrian economist, called this “creative destruction,” insisting that it was an essential by-product of the innovation that propels an economy forward.

If the corporate world continues to experience creative destruction, then the Magnificent Seven will no longer be so magnificent and the GRANOLAS will become soggy. Future periods’ top performers will have little to no overlap with the today’s top performers.

This pattern was documented by Research Affiliates, which studied the performance of the 10 largest-cap U.S. stocks at the beginning of each decade. Rob Arnott, the firm’s founder and chairman, wanted to know how many of those stocks remained in the top 10 list at the end of that decade. The result: on average since 1980, the answer is two. Furthermore, on average the 10 largest stocks from the beginning of each decade significantly lagged the market over that decade.

The bottom line? The only way to make money from Wall Street’s story telling about top stocks is to know in advance which ones they will be. Good luck with that. Take Netflix

NFLX,

one of the original members of the FANG group. It was hot until it wasn’t; over the past five years the stock has lagged the S&P 500

by 3.8 annualized percentage points, according to FactSet data. Similarly, shares of Magnificent Seven member Tesla have done so poorly of late that I’m betting it will soon get kicked out of the Magnificent Seven. Over the past three years, Tesla has lagged the S&P 500 by a staggering 15.2 annualized percentage points.

If you are unable to predict which stocks will be in Wall Street’s next special grouping, then the only way to make sure you will own them is to invest in the market as a whole, preferably via a low-cost broad market index fund.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Plus: This grouping of stocks has actually kept up with the Magnificent Seven, and with a lot less risk

More: Why the stock market ‘doesn’t look very bubbly’ to Ray Dalio right now

Source link