Flood-Prone Basement Housing in New York City and the Impact on Low- and Moderate-Income Renters

Hurricane Ida, which struck New York in early September 2021, exposed the region’s vulnerability to extreme rainfall and inland flooding. The storm created massive damage to the housing stock, particularly low-lying units. This post measures the storm’s impact on basement housing stock and, following the focus on more-at-risk populations from the two previous entries in this series, analyzes the attendant impact on low-income and immigrant populations. We find that basements in select census tracts are at high risk of flooding, affecting an estimated 10 percent of low-income and immigrant New Yorkers.

Flood Risk and Basement Data

For our analysis, we combine data on flood risk from the Federal Emergency Management Agency (FEMA) and the First Street Foundation. FEMA’s data primarily rely on coastal and riverine flooding, using the 100-year return period to determine a neighborhood’s flood risk. The First Street Foundation data measure river (fluvial) and precipitation-driven (pluvial) flooding as well as coastal flooding, enabling us to identify flood-prone areas in addition to FEMA’s 100-year floodplain. Flood Factor is determined at the property level and “specifically looks at the likelihood of 1 inch of water reaching the building footprint of a home at least once within the next 30 years.” (Please see First Street Foundation for a description of the 1-10 scale for flood factor.)

Basement dwellings are among the most vulnerable to flooding. We focus on the basement structures that are most likely to be in residential buildings, using the PLUTO (Primary Land Use Tax Lot Output) Database, which contains tax lot-level information about properties and land in New York City. We adopt and modify a data-filtering process from the Citizens’ Housing and Planning Council’s (CHPC) Hidden Housing report and divide basements into “flood-prone” and “viable” categories using flood risk metrics from FEMA and First Street Foundation.

Do Low-Income Renters Face Elevated Risk from Floods?

New York City’s rental housing market is notoriously tight, with a recent report suggesting that the city is facing its worst affordability crisis in two decades. Based on this report, half of the city’s households lack the means to cover the monthly cost of housing, food, healthcare, and transportation, creating challenges for low- and moderate-income (LMI) populations in finding affordable housing. In addition to these general challenges, low-income renters are particularly vulnerable to natural hazards. Standard renters’ insurance does not cover flood damage, and federal relief programs, in the event of a federal disaster declaration, offer only basic coverage for renters.

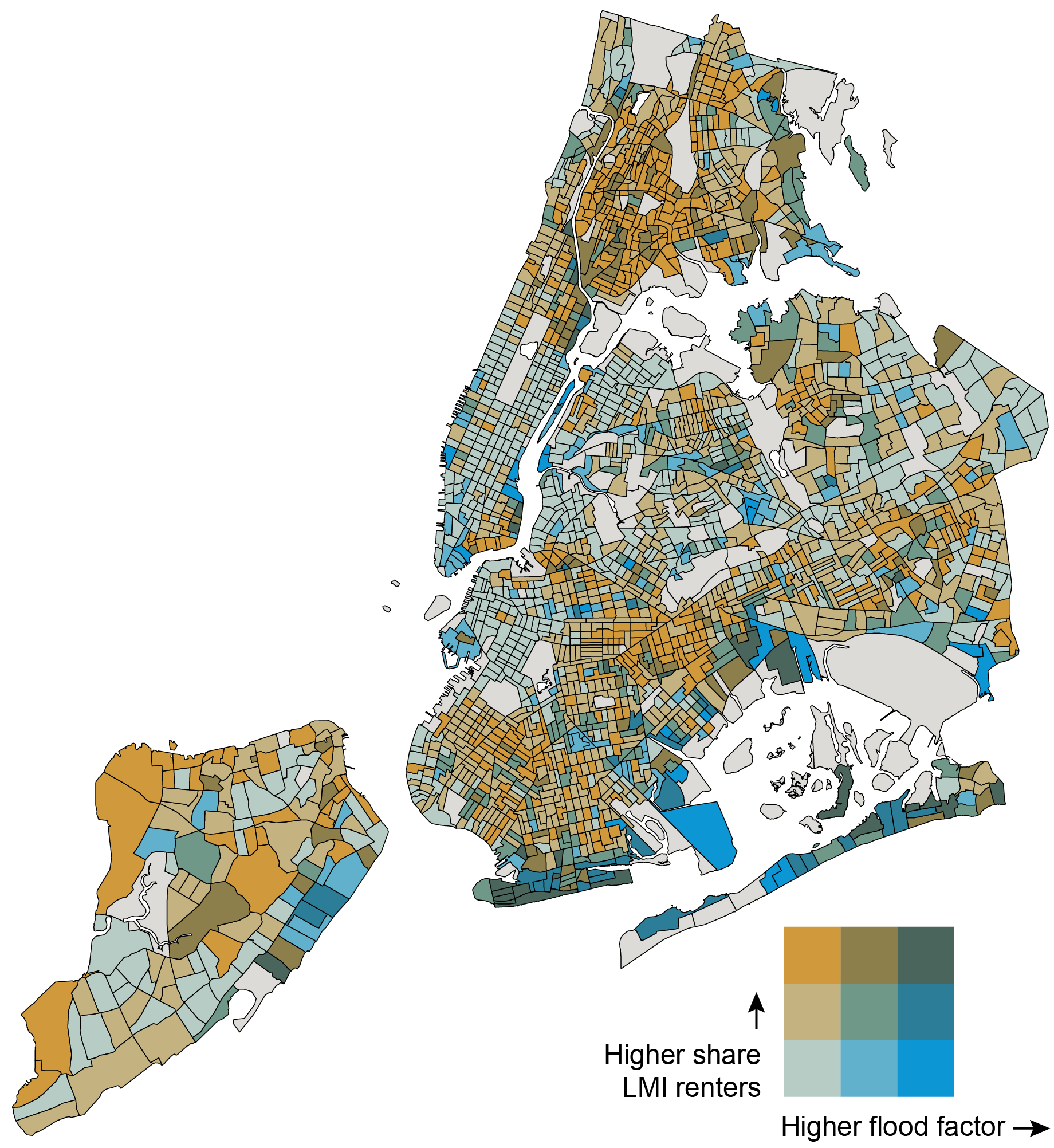

The map below examines two variables, flood risk and the share of LMI renters by census tract, with deeper shades of green identifying tracts with the highest flood risk and highest share of low-income renters. Deep gold indicates areas that house dense populations of LMI renters but are less flood-prone. Deep blue indicates areas that have the highest flood risk but have less dense populations of LMI renters.

The tracts with the highest flood risk for low-income renters include east Bronx, East Harlem, the east coast of Staten Island, southern and eastern Brooklyn, the Lower East Side of Manhattan, and southern Queens. The census tracts at highest risk tend to be located on coastlines, but there are several census tracts in Brooklyn, Queens, and the Bronx that are located more inland and show a moderate to high risk of pluvial flooding for low-and-moderate income renters. This is a notable danger, as pluvial flooding is not always captured in the flood information used to qualify households for disaster assistance and insurance and suggests that asymmetric information on flood risk may put certain LMI renter households at increased risk of property damage and broader harm from inland flooding.

Flood Risk and LMI Renter Populations in New York City

Sources: American Community Survey (5-year, 2017-2021); First Street Foundation (2021).

Notes: Dark gray census tracts indicate areas for which data are not available. The numeric buckets for the flood factor axis are 0-35 percent, 35-67 percent, and 67-100 percent. The numeric buckets for the share of LMI renters axis are 0-31 percent, 31-64 percent, and 64-100 percent.

Where Is Basement Housing Stock Relative to Flood Risk and LMI Renter Populations?

For neighborhoods with higher populations of LMI renters and/or acute housing shortages, basement housing can serve as an important part of the housing stock. Average rental costs of basement dwellings are lower than above-ground apartments, with savings estimates of 20 percent or more. This makes basement apartments attractive to thousands of New Yorkers.

In the table below, we estimate the amount of basement housing stock that is vulnerable to flooding. This refers to basements in census tracts where the flood factor defined by First Street Foundation is greater than 3 (encompassing moderate, 3-4, to severe, 9-10, flooding) and the share of properties in a Special Flood Hazard Area is greater than 10 percent.

Flood Risk Implications for LMI Renters in Potential Basement Housing Stock

| NYC Census Tracts | Low Share LMI Renters (<30%) | Moderate to High Share LMI Renters (≥30%) |

| Low Flood Risk (< 3 FF, < 10% SFHA) |

45,403 basements (19% of all basements) |

168,668 basements (72% of all basements) |

| Major to High Flood Risk (≥ 3 FF, ≥ 10% SFHA) |

503 basements (<1% of all basements) |

4,065 basements (2% of all basements) |

Notes: Percentages in the table do not add up to 100 percent, because the basements that may either be in a census tract where the flood factor is less than 3 and the share of SFHA properties is greater than or equal to 10 percent OR a census tract where the flood factor is greater or equal to 3 and the share of SFHA properties is less than 10 percent are not included in the potential basement housing stock, but are included in the total number of basements.

The most vulnerable census tracts are those with higher shares of LMI renters and higher flood risk, and we estimate that potentially 4,065 basement units are likely to house LMI renters in areas at risk of major to severe flooding. This is eight times the number of basement units (503) located in high flood risk census tracts with smaller populations of LMI renters, where there is a smaller likelihood of basement unit residents. While basements in areas with high flood risk and higher shares of LMI renters constitute 2 percent of all basements in the city, 72 percent of all basements in the city occur in areas with low flood risk and higher shares of LMI renters, indicating a presence of safer and more viable basement housing stock for LMI renter populations that have limited housing choice.

Basement Housing: Viable versus Flood-Prone

We categorize census tracts (and the basements in them) as “flood-prone” if they have a flood factor of 3 or above (encompassing moderate, 3-4, to severe, 9-10, flooding) and/or if more than 10 percent of the properties in the census tract fall in a Special Flood Hazard Area (SFHA). “Viable” basements are in census tracts that have a flood factor of below 3 and less than 10 percent of properties in an SFHA.

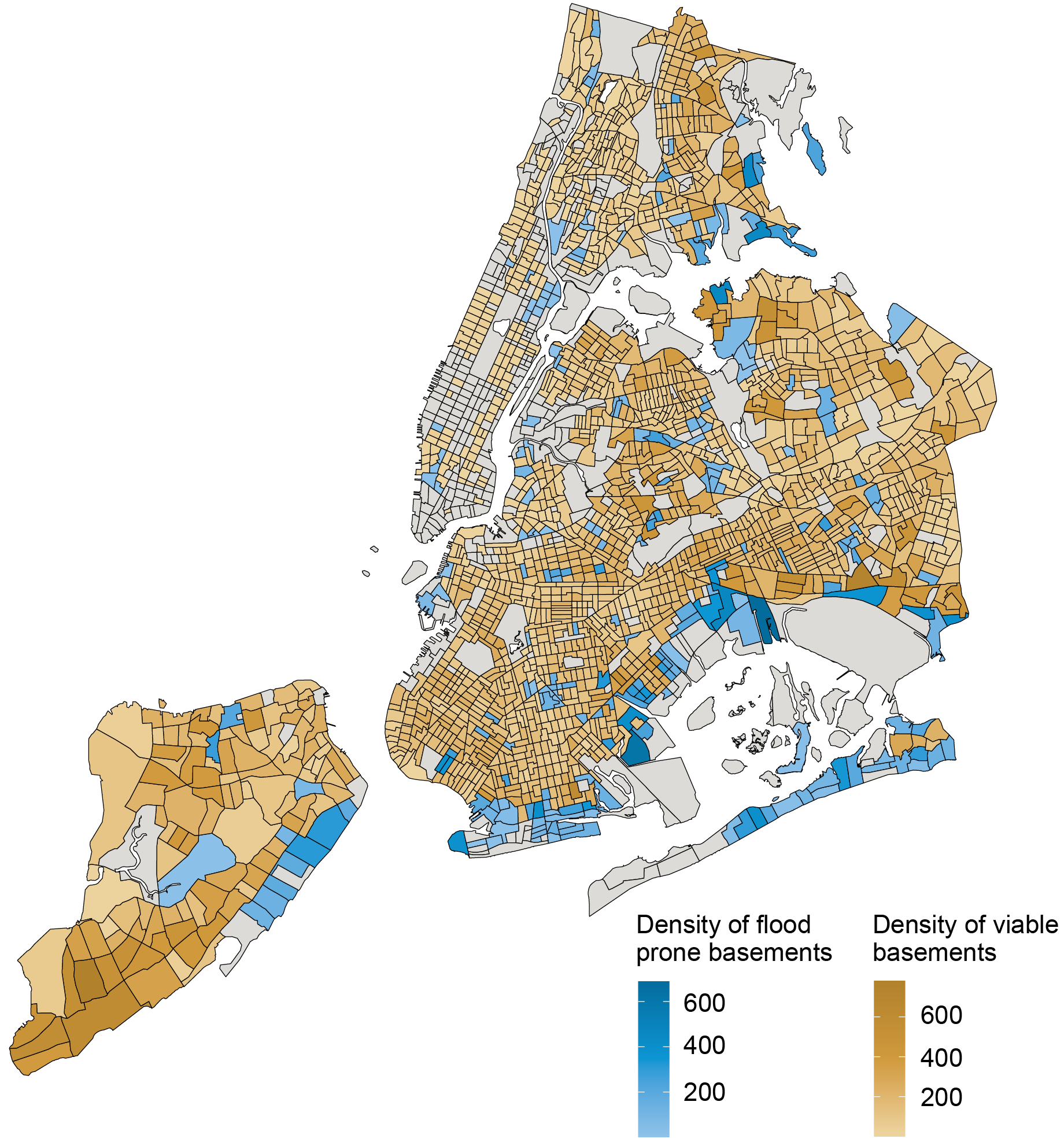

The map below indicates that basement dwellings in most census tracts in New York City are viable, but census tracts vary in the density of basements. High concentrations of viable basements are in southern Staten Island, southern Brooklyn, southern Queens, and Flushing, while higher concentrations of flood-prone basements are in East Harlem, eastern Staten Island, the east and south Bronx, and, notably, parts of southern Brooklyn, southern Queens, and Flushing.

Density of Potential Basement Dwellings by Census Tract (Viable vs. Flood-Prone)

Sources: PLUTO NYC Database version 23.1; First Street Foundation (2021); FEMA.

Notes: Dark grey areas indicate that there are no identifiable potential basement dwellings in the census tract, given the data filtering process we undertook.

The highest densities of flood-prone basement housing still occur along the coastlines of the city, particularly in Canarsie, Coney Island, Howard Beach, and East New York. These basement units are also in census tracts with severe to extreme flood risk scores.

In the table below, we calculate the shares of low- and moderate-income people, immigrants, and racial/ethnic minorities living in a flood-prone census tract. Approximately one in ten LMI individuals, immigrants, and racial/ethnic minorities in New York City live in a flood-prone census tract, a significant share of each of these populations. The informality of basement housing often means that the city’s most vulnerable communities are likely to take up residence in these dwellings.

Flood Prone Census Tracts by Demographics

| LMI | Immigrants | Racial/Ethnic Minorities | |

| Census Tracts with Flood-Prone Basements |

9% | 9% | 10% |

Note: Percentages reflect the share of the total population in tracts with moderate to high flood risk (flood factor of 3 or above and >10 percent of properties in a Special Flood Hazard Area).

Conclusion

This blog post introduces new data to estimate with greater precision the flood risk to basement apartments in New York City. We show that these risks potentially affect roughly 10 percent of LMI individuals, immigrants, and racial and ethnic minorities. For expanded analysis and insights, please look for our upcoming report on flood risk and basement housing in New York City, to be released by the New York Fed’s Community Development & Outreach Group.

As the formalization of the city’s basement housing stock is debated, it is important to consider accounting for both inland and coastal flooding and the vulnerability of LMI, immigrant, and minority populations in assessing viable basement housing stock. The importance of considering the impact of extreme events like hurricanes on activity in the Federal Reserve’s Second District is further examined in the next blog post of this series, which examines the impact of hurricanes on Puerto Rican banks.

Claire Kramer Mills is a community development research manager in the Federal Reserve Bank of New York’s Communications and Outreach Group.

Ambika Nair is a community development outreach analyst in the Federal Reserve Bank of New York’s Communications and Outreach Group.

Julian di Giovanni is the head of Climate Risk Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Claire Kramer Mills, Ambika Nair, and Julian di Giovanni, “Flood-Prone Basement Housing in New York City and the Impact on Low- and Moderate-Income Renters,” Federal Reserve Bank of New York Liberty Street Economics, November 17, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/flood-prone-basement-housing-in-new-york-city-and-the-impact-on-low-and-moderate-income-renters/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Source link