Biden takes another stab at forgiving student loan debt. Here’s how to know if you qualify for his latest $7.4 billion package

The White House has announced a new $7.4 billion round of student loan cancellations, relieving nearly 277,000 borrowers of their debt. The latest attempt to chip away at the amount owed for education means President Joe Biden has now erased a grand total of $153 billion in debt, impacting 4.3 million people.

This round of student loan forgiveness will largely help borrowers who are enrolled in federal loan forgiveness programs including the Saving on a Valuable Education (SAVE) Plan, which offers lower monthly payments based on income, and income-driven repayment plans, which are based on a percentage of a borrower’s monthly discretionary income. People who qualify for the newest loan cancellations will start receiving emails on Friday.

Of the $7.4 billion forgiveness round, $3.6 billion will go to 207,000 borrowers enrolled in the SAVE plan and $3.5 billion is saved for 65,800 people registered in income-driven repayment plans. That leaves about $300 million for 4,600 people enrolled in the Public Service Loan Forgiveness program who will also receive debt forgiveness.

The SAVE plan differs from other income-based loan plans in that it typically leads to lower monthly payments and it’s meant to limit loan balance growth, which can happen under other income-based plans due to unpaid interest. Under the SAVE Plan, “any remaining accrued interest will be covered by the government, so your principal balance won’t increase,” according to the Federal Student Aid.

Biden has continued student loan forgiveness in rounds after the Supreme Court last summer blocked his grand plan that would have wiped out $400 billion in student loans. It would have forgiven up to $20,000 in federal student loan debt for tens of millions of borrowers. The plan was supported by high-profile Democrats in Congress, including Elizabeth Warren and Chuck Schumer— and they even pushed for more dramatic cancellation plans. But it was controversial since it was first announced in August 2022. The plan spurred several legal challenges, with two related cases making it to the nation’s highest court, arguing that Biden didn’t have the authority to forgive debt without approval from Congress. The original plan was ultimately blocked in a 6-to-3 decision in June 2023.

But last week, Biden unveiled his backup plan to bring the total number of people with canceled debts to 30 million since the administration’s efforts began three years ago.

How rampant is student loan debt?

Currently, more than 43.2 million Americans have federal student loan debt, totaling more than $1.6 trillion, according to Education Data Initiative, a higher education research group, with the average borrower owing $37,000. Income-driven replacement plans, including the SAVE Plan, have provided $49.2 billion in debt relief to more than 996,000 borrowers.

The issue of student loan debt is only set to get worse as the price of higher education continues to rise. The average price of tuition at a public four-year college is 23 times higher than in 1963, according to an Education Data Initiative report.

And as higher education costs rise, so too does Biden’s commitments to reducing borrowers’ accumulating debt. He extended a pause on student loan payments for three years between March 2020 until September 2023; in November 2021, he canceled $11 billion in student loans, and last December, he announced a $4.8 billion student debt relief package for more than 80,300 people.

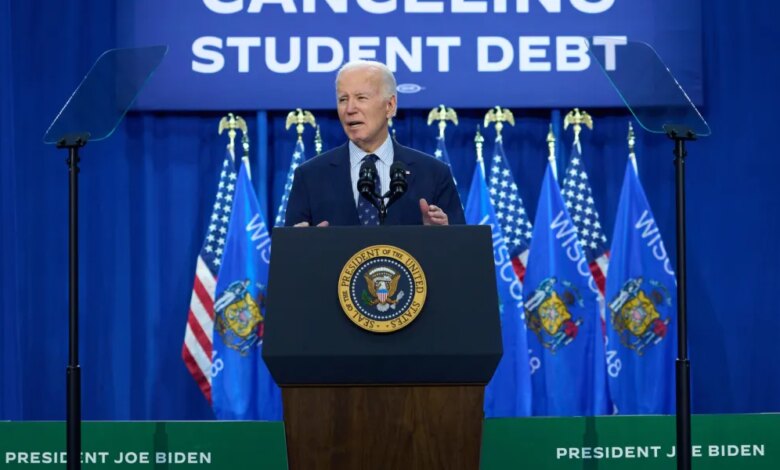

More recently, while at a campaign stop on April 8 in Madison, Biden unveiled a new plan to help 25 million borrowers lower their debt, with an offer to send at least $5,000 in relief to 10 million borrowers. He’s also proposed making community college free so “more Americans can access the promise of higher education.”

The “current student loan system and repayment programs don’t reach all borrowers, and for many Americans student loans continue to be a barrier,” Biden said in an April 8 statement.

Source link