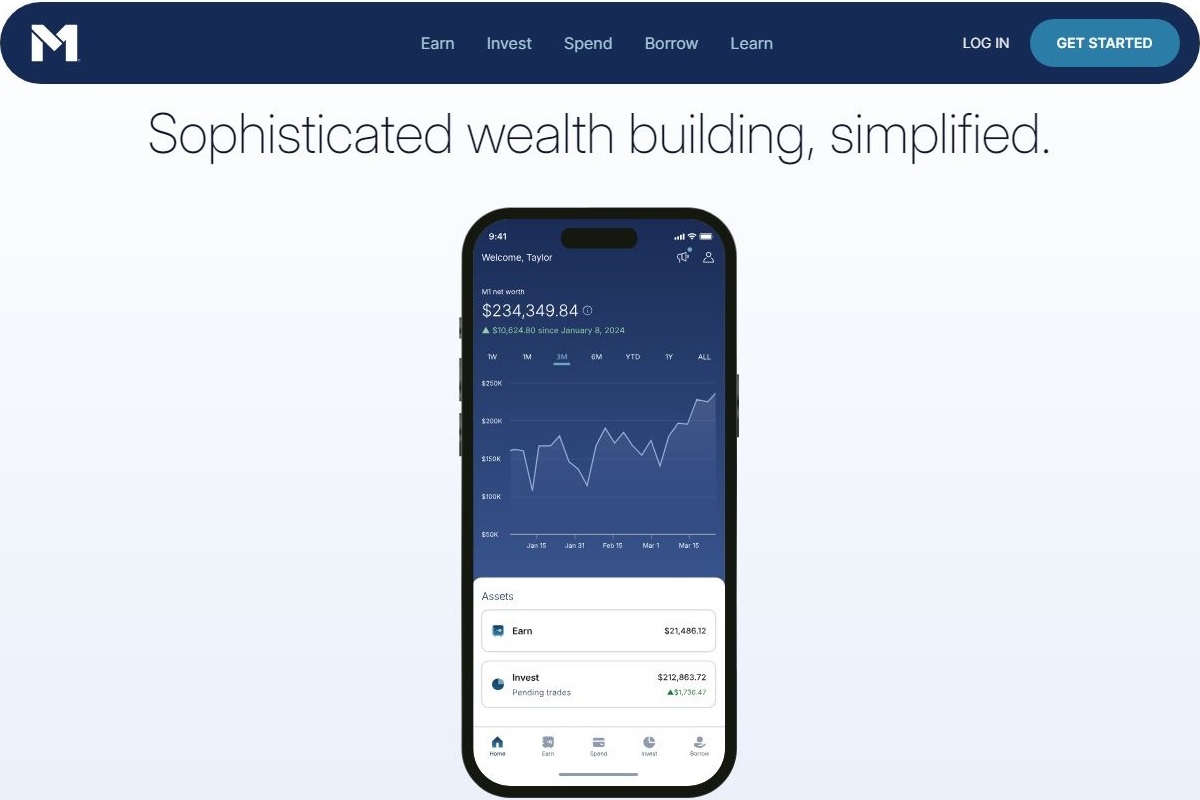

I’ve been investing on the M1 Finance platform since 2017. I was attracted by the intuitive way investors can design their ideal portfolio first and then fund it over time.

This method differs from the traditional way of investing excess cash flow — buying individual holdings every month or so.

With M1 Finance, any time you have free cash to deposit into your Invest account, it automatically feeds your ideal portfolio by purchasing the underweighted holdings, continually building toward your target allocation. So, you’re constantly optimizing your investments as you dollar cost average over the long term.

But M1 Finance has become so much more — a Finance Super App — providing financial solutions for high-yield cash, sophisticated dividend tracking options, credit card spending and rewards, borrowing, and crypto.

I’m updating this M1 Finance review for the third time after eight years on the platform. As the platform has matured, I’ve become more inclined to use its tools for more of my finances.

Please note that everything I write about in this article is my opinion. This is not financial advice. RBD is a long-time affiliate partner with M1 Finance. If readers use links in this article or email newsletter to open an M1 Finance account, RBD will be compensated.

Overview

M1 Finance is my favorite brokerage for beginner investors because it’s more intuitive than the traditional brokerage model.

It’s the best broker for dividend reinvestment, especially with the 2024 dividend handling and tracking enhancements (see my YouTube video on the subject).

That’s because instead of building your portfolio brick by brick, one stock or fund at a time, you design your ideal portfolio first, then fund it over time according to your design specifications. You can make adjustments on the fly.

The platform is designed for long-term investors, not traders. We should all have a long-term mindset, and M1 Finance helps to keep us focused on our overall portfolio instead of individual holdings.

It’s the perfect place for dollar-cost averaging (DCA) into both individual stocks and index ETFs because automation is built into the platform.

M1 Finance almost single-handedly rendered DRIP investing (dividend reinvestment plans) obsolete. If you still have DRIPs with a transfer agent such as Computershare, transferring them out is long overdue.

You can start investing with M1 Finance with just $100. It’s available for both desktop and mobile. Users with accounts under $10,000 will incur a $3 platform fee (see how it can be waived below).

This M1 Finance review will primarily focus on the M1 Invest feature because that’s what I mostly use. But it will also cover the Earn, Borrow, and Spend features.

My primary brokerage is Fidelity because that’s where my employer-sponsored accounts and IRAs have been for more than two decades. I also have a larger taxable account there.

I’m comfortable at Fidelity and have no plans to transfer those accounts to M1 Finance.

I started using M1 Finance to replace DRIP investing strategy that I had done since 1995. Now, I mostly purchase ETFs.

I also use the Borrow and Earn features, as the rates are competitive against other banks.

This M1 Finance review is broken up into four main sections: M1 Invest, M1 Earn, M1 Borrow, and M1 Spend. Follow the breadcrumb images (below) to track which sections I’m referencing.

M1 Invest Review

How M1 Finance Works

M1 Finance was started in 2012 by a 25-year-old Stanford graduate named Brian Barnes. He couldn’t invest the way he wanted to on existing platforms, so he created his own and assembled a team of experienced securities industry executives to launch it.

Instead of a traditional brokerage where investors buy and sell one holding for each trade, M1 Finance has you create “pies”. A pie is simply a group of individual stocks or ETFs. M1 uses pie charts, tables, and a performance graph to display stock and ETF portfolios.

With pies, you choose your investments as “slices” and then allocate a percentage of your total pie toward each slice.

When you deposit cash into your Invest account, the platform automatically allocates your money based on how you’ve set up your pie. Underweight pies and holdings will receive new investment dollars first.

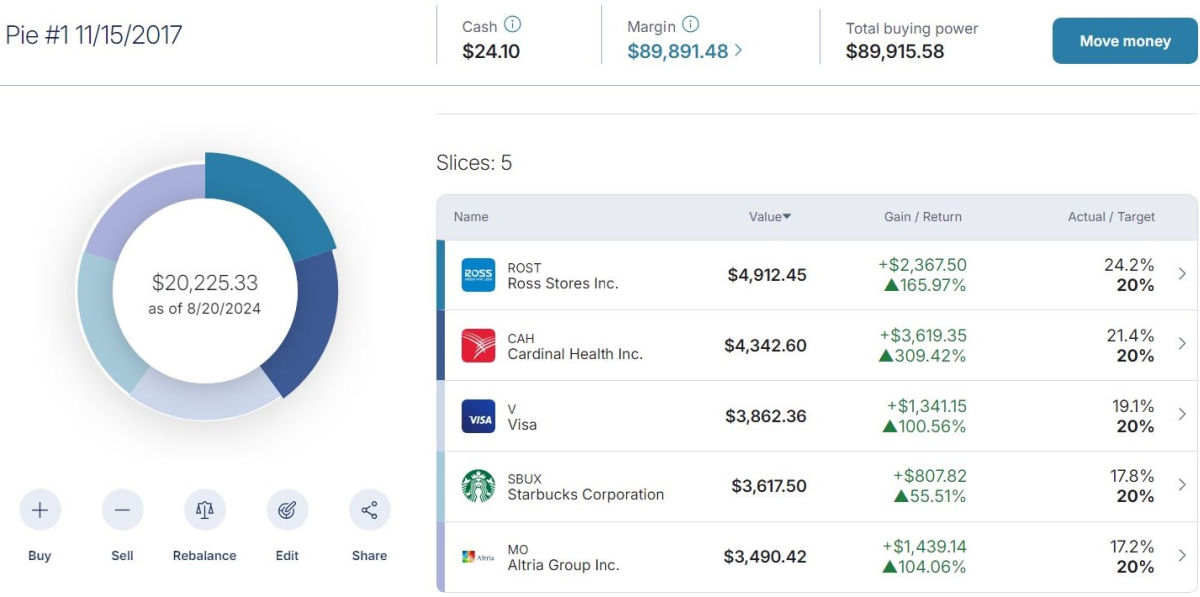

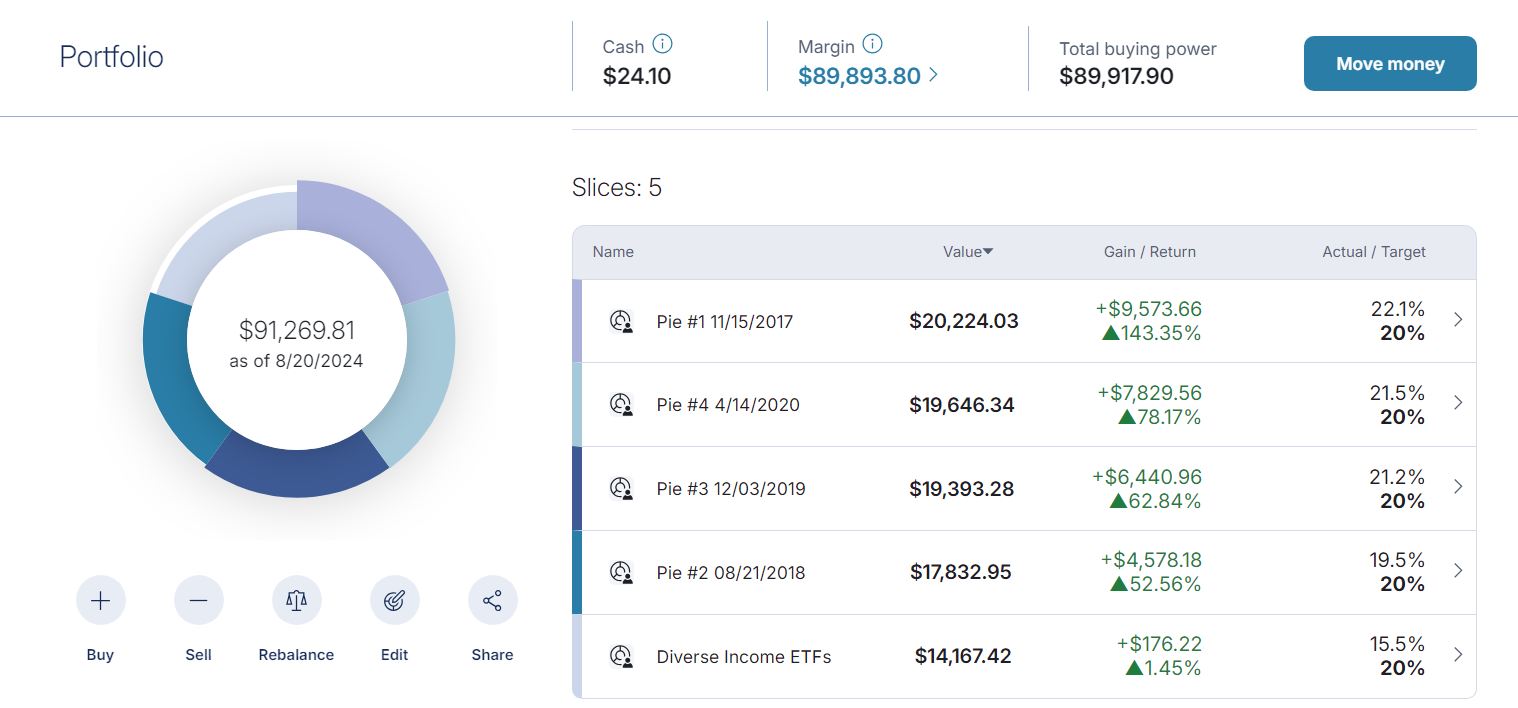

Here’s a snapshot of a typical Portfolio — my portfolio as of August 2024.

My Portfolio is made up of five pies, each with five different holdings (not visible in the above view). This view shows that Pie #1 is overweight at 22.1%, and the “Diverse Income ETFs” pie is underweight at 15.5%.

So, when I add new funds to the portfolio, all of it will go toward the Diverse Income ETFs pie until it is equal-weighted to the next underweight slice (Pie #2). Of course, the value of each slice changes with the market, so the portfolio status and where new money is invested is dynamic.

This next screenshot looks at the Pie #1 details.

Each pie has its own composition and weight. As you add more money to the portfolio, each pie and the total portfolio approach the target allocations.

Here’s a brief introduction video. This is a bit dated, but is still a good look at how the Invest platform works:

My M1 Invest account is an individual/taxable account. Other supported account types include Joint, Traditional IRA, Roth IRA, SEP IRA, Custodial, and Trusts. M1 Finance accepts transfers from outside individual brokerage accounts, IRAs, and 401(k) rollovers.

Customizing Your Pie

You can build a basic portfolio from scratch, adding as many stocks or ETFs as you like. Or organize your portfolio into multiple sub-pies as part of the main portfolio.

When you add a stock or ETF to your pie, you choose the percentage you want each slice to be.

When you deposit money into your account, M1 purchases the stocks and ETFs that balance the percentage allocations set in the pie chart.

The Research tab empowers you to search and filter to find the right stocks or ETFs. You can choose from Model Portfolios crafted to meet particular goals or investment themes, including income earning, social responsibility, and risk tolerance.

Choose your perfect strategy and modify it any time you wish.

M1 Finance utilizes trading windows to keep costs low, meaning that all its trades are executed in a batch transaction twice a day for all users.

Because of the batch processing and structure of the pies, fractional shares are the norm.

The platform intelligently rebalances your portfolio every time you deposit money. Or you can rebalance your portfolio at any time with the click of a button. You can add or remove investments as you please.

A built-in Tax Minimization feature chooses the highest cost share lots when you reduce a holding from the pie (sell), which is ideal for tax-loss harvesting.

M1 Dividend Features

M1 Finance has upped its dividend investing game. Since its founding, M1 has catered to dividend investors by the nature of its platform. But the latest dividend investing enhancements have taken it to a new level.

I made a detailed YouTube video of the updated feature. View it below or on YouTube. I’ve also provided a few screenshots below.

Dividend Income Visualizer

The dividend income visualizer estimates for investors how much income they can expect to earn each month. It displays the total income expected for the year, paid, pending, upcoming, and average monthly income.

Here’s a look at mine, or check out the video for a more comprehensive look.

This view is similar to what TD Ameritrade used to provide and Charles Schwab provides today. Schwab acquired TD Ameritrade.

I love this view because it shows me what I should expect to earn in the months and year ahead. Last year’s data is also available; hopefully, they’ll save each year’s information in the future.

Dividend investors may also like to see a yearly chart or month-to-month (over multiple years) to see progress over time. For example, it would be interesting to see the March 2023 dividend income next to the March 2024 income.

This view is only available on desktops as of August 2024.

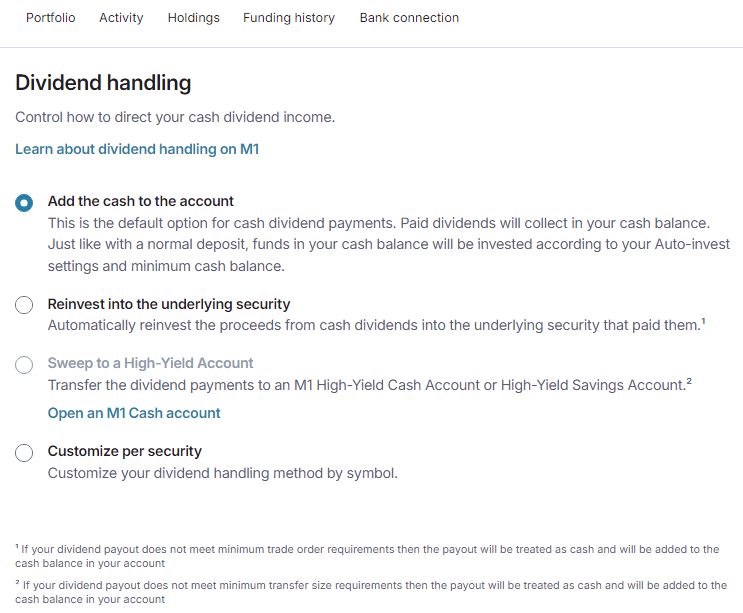

Dividend Handling

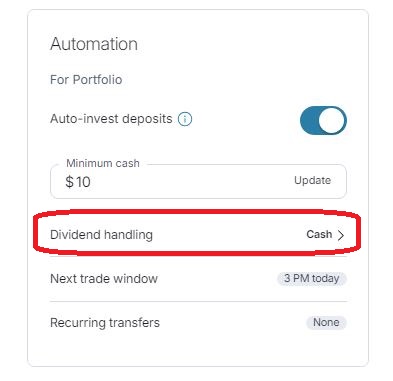

The other significant dividend enhancement now offered by M1 is dividend handling. M1 allows investors to direct dividend income into various roles.

Previously, dividends would pool into a cash account and be reinvested into the portfolio.

Now, investors can choose from the following:

- Continue to pool cash and reinvest

- Reinvest dividends into the underlying securities that paid it

- Direct cash into a high-yield cash account

- Customize reinvestment per security

Customers can access this feature via the Portfolio/Automation area, then click dividend handling.

Looking at the fine print, if the dividend amount doesn’t meet the minimum trade order of $25, the money will go to the cash account as before. This means only significant holdings that pay a $25 per quarter/payment will be reinvested into the underlying security or high-yield cash account.

Depositing New Funds

With M1 Finance, you can add new funds ad hoc or automatically on a set schedule. This is perfect for dollar-cost averaging, and they’ve made it super easy. Schedule new deposits weekly or monthly on any day.

Automatic rebalancing is built into the platform.

When new money is deposited into the account, either through new deposits or dividends, the platform will appropriately direct those funds into underweighted slices when auto investing is turned on.

You can turn the auto-invest feature on and off or set minimum cash limits to keep some cash on hand instead of investing it all.

Reinvesting and adding new funds brings the underperforming slices closer to the set allocation levels of the pie.

As the size of each slice changes over time due to normal market drift, the investments remain properly balanced through this automation process.

You can always modify the pie allocations, add new stocks, or remove slices.

You must hit a minimum threshold of $25 in cash before the next batch purchase, or you can set a higher minimum cash balance to your liking.

For example, if you receive a $5 dividend, it will sit idle until you receive another $20 or more in dividends or deposits. Once it hits $25, the purchase is made according to your pie allocations. If you maintain a minimum cash level of $10, the auto-invest will kick in at $35, investing $25 and leaving $10 in cash.

Depositing new money does not completely rebalance your pies. If you keep adding money, no sales will take place. A sale will only occur on a full rebalance or when you remove a holding from a pie.

Click the Rebalance button to initiate a manual portfolio rebalance, then confirm. You can rebalance at the Portfolio level or pie level. Remember that any time you rebalance a pie or your portfolio, you will generally initiate a series of buy and sell transactions. Usually, every security sale has a tax effect, which may be a gain or a loss.

I don’t recommend rebalancing unless you are making drastic changes to your portfolio. Adding new funds will automatically rebalance over time. But the larger your portfolio, the more challenging it will be to reach a fully balanced allocation.

Buy or Sell Individual Holdings

M1 Finance allows customers to buy and sell individual securities within pies and portfolios.

You can buy or sell an individual stock or pie piece outside of your regular allocation. M1 has designed this feature to be smooth and easy. Just click the button and make your selection.

After you’ve bought or sold an individual position or pie, subsequent deposits will be allocated to your portfolio’s percentages normally.

So, if you add $1,000 to an individual stock, the other holdings in the pie or Portfolio may take a while to catch up.

Otherwise, the pie and slice target allocations direct new deposits.

Withdrawals and Sales

When you eliminate a holding from your pie, the system sells the security during the daily trade windows. You’ll see the slice of the pie go away. But in the background, the platform makes a normal sale where the cost basis and proceeds are reported to the IRS.

The M1 Finance platform also built a Tax Minimization algorithm for your account. Here’s how it works.

The system uses a tax lot allocation strategy when selling securities to help automatically reduce the amount owed on taxes.

When you request a withdrawal from your account, the algorithm knows which securities to sell based on your allocation percentages. Then, instead of using the normal FIFO (first in, first out) order of sale, the algorithm prioritizes the sale of lots like this:

- Short-term capital loss from the biggest loss to the smallest.

- Long-term capital loss, from the biggest loss to the smallest.

- Short-term zero gain/loss.

- Long-term zero gain/loss.

- Long-term capital gains, from the smallest gain to the biggest.

- Short-term capital gains, from the smallest gain to the biggest.

This helps to minimize your tax liability when removing a holding or withdrawing money. But this should not be confused with tax-loss harvesting that you’ll find at brokers that call themselves robo-advisors.

One thing to remember with an investing platform like this is that the more active you are and the more changes you initiate, the more consequences you’ll have at tax time.

For example, if you create a pie with 60+ Dividend Aristocrats in one year and remove half of them the next, you’ll need to report the capital gains or losses on your tax return. This is OK, but it can cause a bit of extra work for you at tax time. Just watch out how big and complicated you make your pies, and avoid large rebalances to reduce tax time headaches.

Dollar-Cost Averaging

Dollar-cost averaging is when you consistently invest small amounts of money into an investment. This is the best strategy for beginner investors because it’s an easy way to get started (often the biggest challenge).

When I was getting started investing, I didn’t have a lot of money. Sometimes, I only had $25 or $50 to invest. I used the Chevron DRIP program to DCA back in the day.

Newbies sometimes think it’s not worth investing such small amounts. But it is worth it, and now that brokers are trade-commission-free, it is simple and inexpensive.

For this discussion, dollar-cost averaging is when you invest consistently from your monthly excess cash flow, not from a lump sum. M1 Finance enables regular draws from your bank account and smart transfers to automate tasks.

Model Portfolios

M1 Invest offers suggestions for how to invest your money through its Model Portfolios. These pre-designed pies use popular ETFs (mostly Vanguard and iShares) to achieve various investment objectives.

Model Portfolios are located on the Research tab via the desktop dashboard and under Invest/Research on mobile.

There are six categories of Model Portfolios as of August 2024. These are subject to change:

| Category | Description | # of Pies | Sample ETFs |

|---|---|---|---|

| General Investing | Conservative, moderate, and aggressive portfolios | 7 | BND, VOO, MUB, VNQ, SHY |

| Plan for Retirement | Target date portfolios, conservative to agressive | 10 | VOO, VB, VUG, VOE, BNDX, BLV, DBC |

| Responsible Investing | ESG portfolios | 2 | NULG, NULV, NUMG, NUMV, NUSC, NUDM |

| Income Earners | Income-focused, bond and dividend portfolios | 6 | TLT, MLN, VCLT, IDV, VIG, DEM, DON, IEF, VMBS, MUB |

| Just Stocks & Bonds | Simple two-fund stock/bond portfolios (e.g., 60/40) | 9 | VT, BND |

| Other Strategies | ARK ETFs, cannabis, value, growth | 6 | ARKQ, ARKF, CGC, ILCV, IWS, IWN, SCHG, VOT, EFG |

M1 Crypto

M1 Crypto accounts are separate from taxable brokerage accounts. Both reside under the Invest tab.

Only three cryptocurrencies are available for direct purchase:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

However, alternative crypto-related ETF assets and bitcoin ETFs are available via taxable accounts or IRAs via ETFs.

M1 Earn

M1 Earn is a high-yield cash account that allows customers to easily hold cash on the M1 platform and earn a significant yield.

The yield as of August 2024 is 5.00%. Check here for the latest yield.

There are no minimum balances or withdrawal limits. But M1 Earn requires that customers have an M1 taxable brokerage account (non-retirement) to be eligible.

This is not a bank account, and M1 Finance is not a bank.

However, funds transferred into the Earn account are FDIC-insured up to $3.75 million, which is significantly higher coverage than the standard $250,000 FDIC insurance.

M1 Earn accomplishes this higher FDIC insurance level by sweeping funds from the M1 Finance brokerage account (where funds are SIPC-insured) into a network of partner banks providing FDIC insurance.

Customers can open up to four high-yield cash accounts, and they can be opened as individual or joint.

M1 Borrow

Margin Account

The primary M1 Borrow feature is a margin account, which allows you to borrow money against your brokerage account balance. Most margin accounts are used to invest in more stocks to ‘leverage’ your investment portfolio. This is common in option investing, which M1 Finance does not provide at this time.

I don’t advocate using leverage to invest. Margin accounts involve an additional layer of risk, so do not borrow and invest without understanding the terms.

It doesn’t make sense to borrow at a higher rate than cash savings, to invest in lower-yield dividends or higher-risk stock market returns.

However, customers can use M1 Borrow money for anything, and it’s a relatively cheap place to borrow money compared to a credit card, some personal loans, and other borrowing options.

Only accounts with assets totaling $2,000 are eligible for M1 Borrow. Portfolios should be sufficiently diversified. Eligible investors don’t need to apply to use the feature.

The idea is to offer a cheaper alternative to credit card debt that consumers can use for anything. This is a decent alternative if you need short-term cash and don’t want to sell investments.

M1 Personal Loans

M1 Personal Loans offer an alternative to borrowing against your investment portfolio. This is not a margin loan but more of a traditional loan that will look at your income, assets, and credit history for approval.

Fixed-rate APRs range from 7.99%–21.75%, and customers can borrow between $2,500–$50,000 for terms of 2-7 years.

There are zero fees — no origination fees, late fees, prepayment fees, or any other hidden fees. You can use the money for almost anything, like consolidating debt, funding major purchases, making home improvements or repairs, paying medical bills, and more.

M1 Personal Loans are furnished by B2 Bank NA, Member FDIC and Equal Opportunity Lender, and serviced by M1 Spend LLC, a wholly-owned operating subsidiary of M1 Holdings, Inc.

M1 Spend — Owner’s Rewards Card

M1 Spend is a rewards credit card available to M1 Finance clients. It is not a standalone product.

Clients earn 2.5%, 5%, or 10% cash back on purchases when shopping with brands in the Owner’s Rewards Program, which includes 20+ popular brands.

Cardholders earn 1.5% cash back on all other purchases. Customers can automatically invest cash-back rewards into their M1 portfolios, making this a compelling alternative to traditional travel and cash-back rewards.

The card comes with Visa Signature® benefits, including Visa® Zero Liability. There’s a $5,000 minimum credit line and a $200 cash-back limit per calendar month.

The Mobile App

M1 Finance is completely accessible both through a PC desktop and mobile app. The company built both sides from the start, unlike other fintech brokers like Robinhood and Webull.

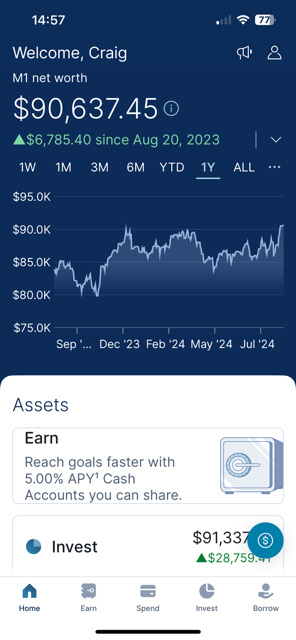

The user experience is very similar on a mobile device. Here are some screenshots to help you get acquainted with the app. These screenshots were taken from my account in August 2024 after a significant redesign.

Here’s the main view when you log in:

The next view is the Invest tab, showing my portfolio as a pie chart. You can also see the first three pies and the current buying power (how much cash is on hand).

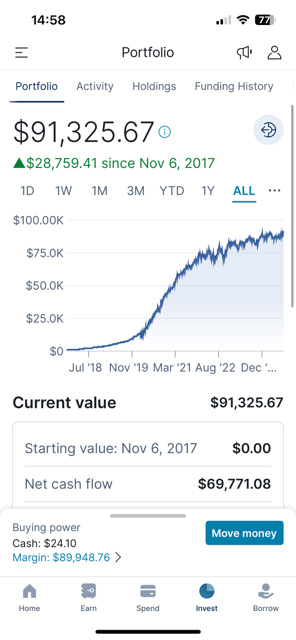

Here’s another view of my portfolio showing growth over time. I opened this account in 2017 and slowly added funds over five years. I’ve slowed new investments in the past two years as I transitioned away from full-time work.

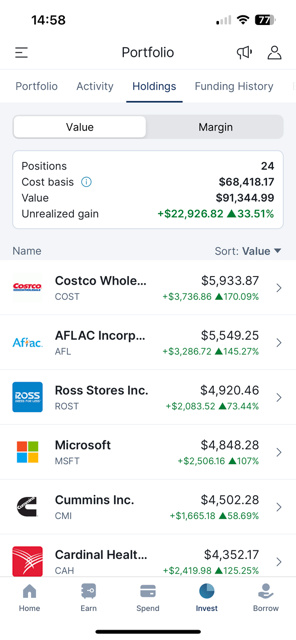

Next is a list view of my holdings. Costco has been the best-performing stock since I started buying it in this account in 2020.

M1 Finance Pros and Cons

What I love about M1 Finance is that it listens to suggestions and makes changes to improve the user experience. It helps that I’m an affiliate partner, and multiple suggestions I’ve made over the years have been implemented, including early improvements to dividend income tracking.

There’s also a vocal community that is not afraid to voice concerns.

Pros

- Multiple financial account types

- Dynamic dividend investing enhancements

- High-yield cash account + investing + borrow

- Intuitive investing platform, unlike traditional brokers

Cons

- Monthly platform fee (waivable)

- Cannot merge pies online

- Frequent nudges to open additional accounts

- Can only connect one external bank account

- No checking accounts (they closed a previously supported checking product)

- “M1-is-definitely-not-a-bank” but still offers bank-like products

Monthly Platform Fee

Accounts under $10,000 will incur a $3 monthly platform fee. This is unfortunate. I’ve been relaying this opinion to my contacts at M1 to no avail.

Treat a small customer well, and they’ll be a loyal customer for life. Advertise a $3 monthly fee to a potential lifelong customer, and they’ll go elsewhere.

The fee is waived for 90 days, then for accounts over $10,000. This allows new customers to “test the waters”. But in reality, they will lose sign-ups because switching accounts is too much of a hassle.

Ways to waive the fee:

- Having an active M1 Personal Loan

- If a client’s M1 assets reach a minimum value of $10,000 for at least one day during each billing cycle

- M1 assets include the aggregated settled value of all M1 Investment and Earn Accounts.

Cannot Merge Pies Online

This is a longstanding issue with the platform. I would like to consolidate a few pies and cannot do so online or within the app.

Customers must call customer service to merge pies; you cannot complete this task intuitively on your own. For example, there could be a simple “merge pies” functionality, whereby you select two or more pies to merge, and the merge happens by the next day.

I’m told this is a structural IT issue. All pies must have at least one slice. To close a pie, you would need to sell the final holding.

An intuitive and simple solution to this problem would be helpful.

Customers can “move” slices from one pie to another within the same account. This will not trigger a sale or taxable event.

To move a slice, enter a pie, select the slice, then click “Move”. You’ll then select the destination pie, then be asked to reset the allocation percentage for the original pie and the destination pie.

Frequent nudges to open additional accounts

If you only want an Invest account, you’re going to be frequently reminded that there are other products. It’s not as annoying as Robinhood and other apps.

But Spend, Borrow, and Earn are always visible from your dashboard. It is especially cumbersome on desktop. There is no way to hide them or reorder the tabs you use most to the top. You’ll also receive plenty of email marketing for other accounts.

I’d like to see a cleaner desktop dashboard (left side )that allows you to hide links to accounts you don’t have or move them to a less prominent location.

The mobile app also prominently features accounts that are not in use.

One External Bank Account Allowed

M1 Invest accounts can only connect to one external bank account. Most brokerages allow multiple. This is an issue for me because I’m always transferring money around.

I have an external savings account and an external checking account. I’d like to connect both, but I cannot.

M1 would like you to keep all/more of your money with them, and maybe that’s why you can only connect one external account. Counterintuitively, I’d likely move more money to M1 if I could connect more accounts.

No Checking Accounts

M1 previously offered a checking account but closed this service in 2023. Being a finance “super app” is hard without a proper checking account.

M1 is not a bank and does not offer banking services, except the high-yield cash account, which is definitely NOT a bank account, even though it looks, smells, and is insured like one.

“M1-is-definitely-not-a-bank” but still offers bank-like products

The FDIC, FINRA, and the SEC heavily regulate financial services. M1 has been grappling with regulation and compliance for investing and bank-like accounts since its beginnings.

So it’s not their fault. M1 is simply playing within the Federal rules and requirements while offering a seamless experience and compelling products to customers.

My next-door neighbor works for the FDIC and I always joke with him about “technology companies” that offer banking services. He’s explained the rules to me and is a resource as I review various products for RBD and other websites.

In a nutshell, many financial technology companies (fintech app creators) have partnered with banks to build user-friendly bank-like products integrated with financial and investing apps. Banking-as-a-service (BaaS) is now a thing where the banks do what they do best, and technology companies create an excellent user experience.

Even M1’s Founder, Brian Barnes, bought a bank and renamed it B2 with the intent of providing BaaS to other technology companies and M1 customers. B2 only services the M1 personal loans for now, as far as I can tell.

But the company is still working out the regulatory kinks, hence, the messaging across different definitely-not-banking products. They seem to have settled on the high-yield cash account (it is not a savings account) going forward.

Conclusion

M1 Finance is for long-term investors, not traders, which makes it very good for both dividend and index investors.

Since its founding, it has expanded offerings to include crypto investing, a high-yield cash account, margin and personal loans, and a rewards credit card. Customers can now access a variety of financial services via M1, even though it is not a bank.

Here’s some cool insight from the Founder, Brian Barnes:

After all, personal finance is largely free now. Most people’s personal finances revolve around the checking account and the credit card, which are typically free and often even incentivize use through interest, points, or cash-back. The investing account is the final component of personal finance to go [trade commission] free.

Now that the platform is built, M1 Finance believes they can make plenty of money through the back channels of the securities industry. More from Founder Brian Barnes about making money:

Brokerages make money via lending securities they hold, interest on cash held in a brokerage account, extending credit through margin to customers, and getting paid for distributing certain funds or to transact on various exchanges. These revenue streams are more than enough to support a strong, vibrant company.

This is also true at M1, and we will make more money from transactions and holding the assets than we would from our fee. The number one driver of M1’s success over time will be the number of users and assets managed. If going free puts M1 in more people’s hands and empowers them to manage more of their money on the platform, the move to free is a win-win.

M1 Finance is the future of investing today.

M1 Finance Review

-

Ease of use – 9/10

-

Mobile Access – 9.5/10

-

Research Tools – 8.5/10

-

Commissions – 10/10

-

Investment Selection – 9.5/10

-

Non-Investing Services – 9/10

-

Margin Rates – 9/10

9.2/10

Summary

M1 Finance is a top online brokerage for new investors. The user experience takes some time to get used to, but once you get the hang of it, it’s ideal for long-term investors who like to dollar cost average into stocks and ETFs. The non-investing services, M1 Earn, M1 Borrow, M1 Spend, are excellent add-ons for those who like to consolidate financial accounts.

Thanks for checking out my updated M1 Finance review. This article was initially published in December 2017 and substantially revised in October 2019 and August 2024.

I’ll continue to update and modify this review as the platform continues to age and improve. As always, if you have any questions about the platform, please leave your comment below or contact me privately if you prefer. I’m happy to provide more details on anything I missed in this review.

Disclosure: Long all stock symbols visible in images.

Disclosures: M1 is not a bank. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 Savings Accounts are furnished by B2 Bank, NA, Member FDIC. RBD is an affiliate partner with M1 Finance. If you open an account via any links in this M1 Finance review, RBD may be compensated. M1 is a technology company offering a range of financial products and services. “M1” refers to M1 Holdings Inc., and its wholly-owned, separate affiliates M1 Finance LLC, M1 Spend LLC, and M1 Digital LLC.

The opinions expressed are solely those of the authors and do not reflect the views of M1. They are for informational purposes only and are not a recommendation of an investment strategy or to buy or sell any security in any account. They are also not research reports and are not intended to serve as the basis for any investment decision. Prior to making any investment decision, you are encouraged to consult your personal investment, legal, and tax advisors. M1 Invest – Commission-free: M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. You may still be charged other fees such as M1’s platform fee, regulatory fees, account closure fees, or ADR fees. For a complete list of fees M1 may charge visit M1’s Fee Schedule.

Craig Stephens

Craig is a former IT professional who left his 19-year career to be a full-time finance writer. A DIY investor since 1995, he started Retire Before Dad in 2013 as a creative outlet to share his investment portfolios. Craig studied Finance at Michigan State University and lives in Northern Virginia with his wife and three children. Read more.

Favorite tools and investment services right now:

Sure Dividend — Research dividend stocks with free downloads (review):

Fundrise — Simple real estate and venture capital investing for as little as $10. (review)

NewRetirement — Spreadsheets are insufficient. Get serious about planning for retirement. (review)

M1 Finance — A top online broker for long-term investors and dividend reinvestment. (review)