Target Corp.’s stock soared Wednesday following the retail giant’s third-quarter earnings beat, with investors keeping a close eye on the retail sector’s ability boost profit margins.

Target

TGT,

is a top trending stock Wednesday on Stocktwits, a social platform for investors and traders.

“The name of the game in the current environment is earnings management, so investors are heavily focused on discussing which retailers will be able to expand their profit margins further,” Tom Bruni, a senior writer at Stocktwits, told MarketWatch. “This is especially true for Target, because it sells a bigger percentage of clothing, home goods and impulse purchases than rivals like Walmart. As a result, it’s been hit particularly hard by the U.S. consumer’s pullback in spending on discretionary items.”

Related: Target CEO says consumers are still spending, but sees pressure on discretionary items

Nonetheless, Target’s stock surged 17.1% Wednesday, outpacing the S&P 500’s

SPX

gain of 0.1%. Shares of Walmart Inc.

WMT,

which reports its fiscal second-quarter results before market open Thursday, are up 1%.

The next major catalyst for Target and other retailers will be if management shares signs of consumers starting to buy more discretionary items, according to Stocktwits’ Bruni. “So far, we’re not seeing that yet,” he said. “How the upcoming Black Friday and other sale periods perform will set the tone for these companies’ 2024 outlook.”

Other retail giants have also cited pressure on discretionary spending this earnings season. On Tuesday, Home Depot Inc.

HD,

said that it is seeing pressure in certain big-ticket discretionary categories. Home Depot’s stock rose 1.2% on Wednesday.

Related: Target CEO says consumers are cutting back — even on food spending

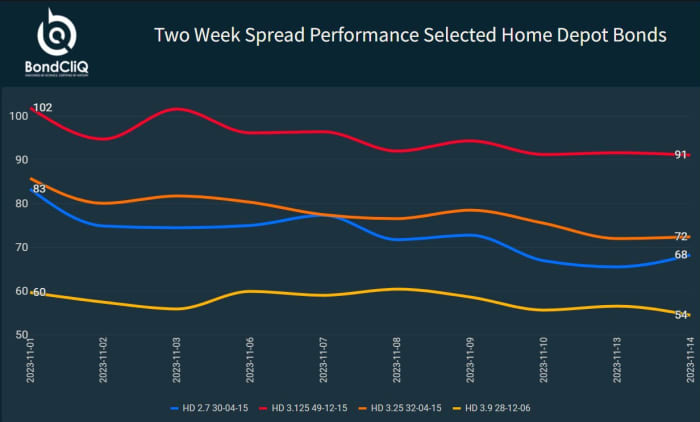

Home Depot bonds have performed well in the last two weeks — as the retailer prepared to report its third-quarter results — according to information from the market-data company BondCliQ. “Their spreads to benchmark U.S. Treasuries have tightened nicely,” BondCliQ told MarketWatch. A tightening bond spread can signal market confidence in companies’ profit margins.

Two-week spread performance of selected Home Depot bonds.

BondCliQ

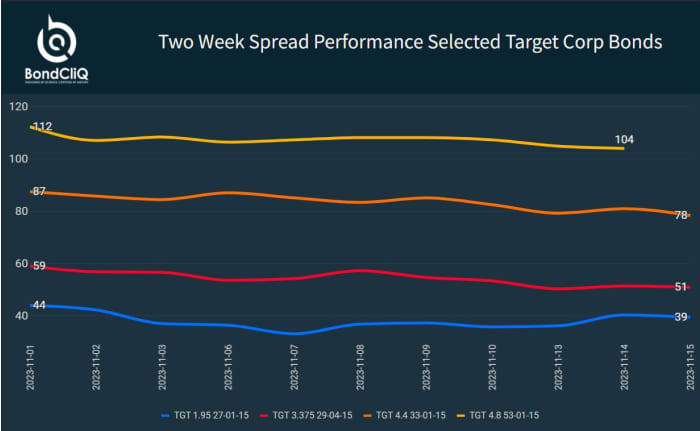

BondCliQ said there have been more sellers than buyers of Target bonds over the same period, even though Target spreads are tightening.

Two-week spread performance of selected Target bonds.

BondCliQ

Source link