For one of every five Americans, the most important fall ritual has nothing to do with leaf-peeping or football or pumpkin spice.

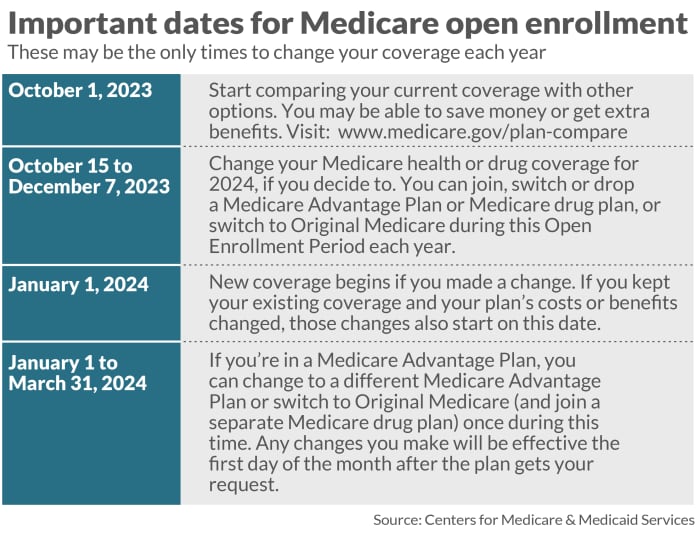

Oct. 15 to Dec. 7 is the annual open enrollment period for consumers to pick a Medicare or Medicare Advantage plan.

The healthcare choice is important but changing for the 60 million Americans on Medicare. In 2023, for the first time, most seniors opted for Medicare Advantage over traditional Medicare, with 30.8 million selecting the privately managed plans.

As a son who has tried to help my own parents select a medical plan, I find the whole process daunting — and I am CEO of a senior health company.

My parents’ mailbox and email boxes started filling with medical sales pitches in the summer — sometimes it’s hard for them to watch their TV shows without a local healthcare ad — and the onslaught doesn’t stop until after the first snowfall.

After seeing both sides of the healthcare selection process as a son and medical executive, I offer these tips to help simplify the shopping for a Medicare or Medicare Advantage plan:

Start by making a list of what’s important

The key here is to match your specific medical needs with the services covered by a particular plan. Do you have medical specialists crucial to your personal healthcare? Make sure they’re covered by your plan. If you rely on one prescription drug, then compare the price under different plans. Some plans offer 24-7-365 phone advice from nurses — that’s a great idea if you want peace of mind, or live far from loved ones and have medical issues that arise in the middle of the night. Are you one of the Northern snowbirds who winter in Florida or Arizona or someplace else warm? Make sure your coverage extends to other states.

Consider the incentives of medical plan brokers

Brokers may be experts on the ins-and-outs of competing plans — and pros at helping you comparison shop — but it’s important to ask how they are paid. Does your broker have a financial incentive to steer you toward a particular plan? Is the broker’s pay reduced if you choose different coverage? Financial transparency is the best and fairest policy.

Is there coordinated care?

Plans that offer a single point of contact can make healthcare much easier — think of it as a medical concierge to coordinate doctors, physical therapists, testing labs, and pharmacists. The best coordinators focus on healthcare, not just sick care, by promoting wellness programs to help you quit smoking, lose weight, and build strength and balance by becoming active again. Another big advantage of coordinated care: Sending help to your house when you are sick or need mobility or rehab help.

Focus on geriatricians

The older we get, the more complicated our medical issues tend to be. A geriatrician is the one doctor, especially trained in aging, who can see how treatments from different specialists affect each other. What happens if several doctors separately prescribe 10 medicines for four conditions? Does your osteoporosis medication have a consequence for memory care? Seniors deserve an expert who is considering your plan for living, not just focusing on preventing death.

Consider personal tech

Remote monitoring can be a lifesaver. Plans with a strong telehealth component — you can talk with a doctor, nurse, or mental health therapist from home via a videoconference on your smartphone or computer — can save you trips to the doctor’s office. Some plans also offer personal tech like Fitbit-style step counters, Apple watches, pulse-oximeter devices, and heart-rate monitors, as well as wearable equipment that notifies helpers in case of a fall or medical event. Medical tech always should come with careful and thorough instruction from patient experts.

The key here is for seniors to look beyond the typical benefits provided by the typical plan. At this point, the standard for Medicare Advantage plans is to cover dental, vision, and hearing coverage.

It’s worth the extra research, though, to find the specific plan that will save you money by promoting wellness and prevention.

The right plan should not confuse you. It should help you age the way you want.

Joel Theisen, BSN, RN, is founder and chief executive of Lifespark, a Minnesota-based senior health company. Follow him on Twitter: @Lifespark_CEO.

Source link